Fostering Allowances & Payments

At Shining Stars Fostering we feel it’s important that our foster carers are treated as professionals and that we pay a competitive foster carer allowance for their work and skills. This allows them to feel valued and appreciated for the challenging work they do.

Our foster carers are paid a weekly allowance, per child, ranging from £425.00 per week or significantly higher for a child with special needs. This is significantly above the government’s minimum fostering allowances that are currently in place.

Fostering Allowance (Foster Care Allowance)

The minimum weekly allowance for Shining Stars’ foster carers is £425.00/week and is significantly higher depending on the type of foster care the child needs. We are one of the top paying foster care agencies in London. This foster income is generally tax free and usually does not affect your benefits.

At Shining Stars Fostering we value our foster carers and the children they care for and believe that they deserve a good quality life.

- You will receive a generous fostering allowance for each child

- You may also be exempt from paying tax on this allowance

- You might also be entitled to Working Tax Credit/other benefits

- You will be registered as self-employed and pay NI contributions

What is fostering allowance?

Foster carers receive an allowance for each child or young person they care for, this is known as a fostering allowance also known as foster care allowance.

Is fostering allowance (foster care allowance) tax free?

In general, foster carers are exempt from paying tax on the fostering allowance / foster care allowance.

For tax purposes, foster carers are regarded as self-employed. You can find out more details about the tax-free payments for foster carers from HM Revenue & Customs.

Does Fostering Allowance (Foster Care Payments) affect benefit entitlement?

As a foster carer you may be entitled to claim benefits and tax credits. The allowances and fee (if you get one) you receive from fostering are normally completely disregarded as income or only taxable profit from your fostering is taken into consideration for the purposes of calculating your entitlement to benefits.

For further information about claiming benefits while fostering visit the Government’s website, or download the HMRC’s leaflet on tax credits.

Source: The Fostering Network

What does fostering allowance (foster care allowance) cover?

We recognise that looking after a child or young person has financial implications which is why as a foster carer you are paid a weekly fostering allowance which is made up of a professional fee for yourself and also a day to day living allowance for the child.

The fostering allowance (foster care allowance) is to cover all the needs (food, clothing, savings and so on) of each child in your foster care. We give a clear guidance on how you can best spend the money so that each child in foster care has a healthy, happy and balanced life.

The fostering allowance is different and depends on the care type and the foster child’s needs. Another factor that is relevant on how much fostering allowance you will receive is whether you are fostering in London or other areas of UK.

Foster payments are hassle-free and are paid electronically, directly into your bank account.

Want to know if you can foster?

Find out if you meet the criteria to become one of our foster carers.

We are recruiting Foster Carers

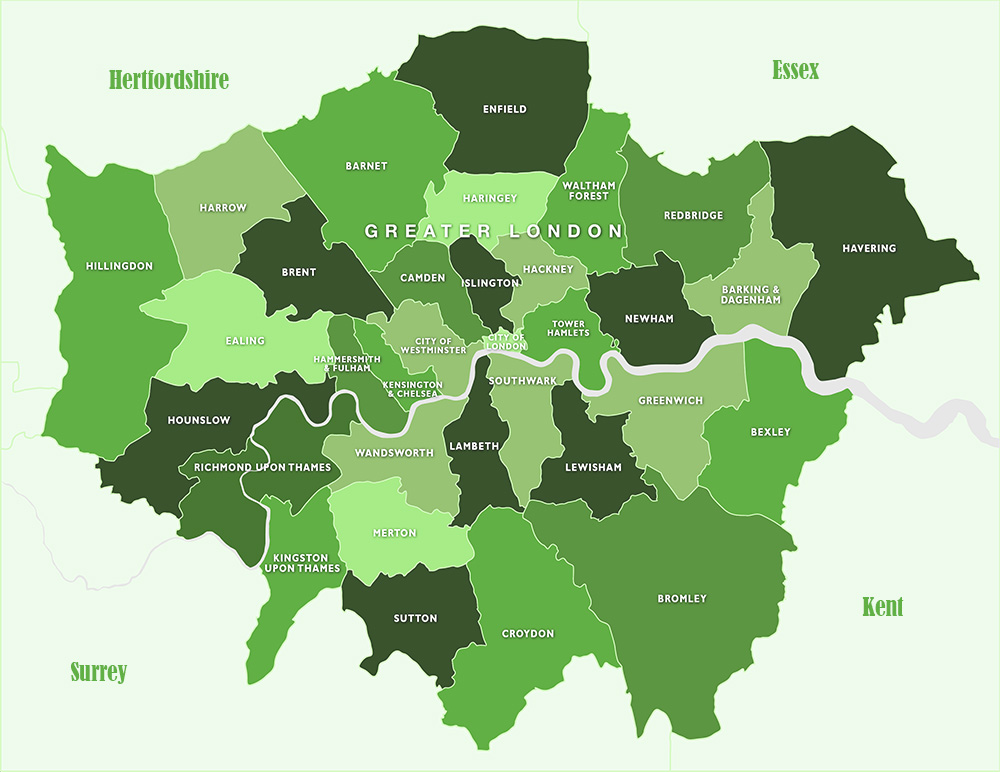

We are currently recruiting foster carers across all the London Boroughs and the surrounding counties. Please go through the website and contact us to register an interest in fostering.

Foster in your area

Register your interest

SSFA has a range Policies and Procedures concerning Social Work Practice, HR and Finance which are used to guide staff and for tendering and commissioning purposes. If any of the issues that are not covered please do contact your supervising social worker or our registered manager who will guide you to the appropriate policy. Shining Stars Fostering Agency Tri-X policies